The wait for your morning coffee: you're behind schedule, and there's a line. You're tapping your feet, uncaffeinated, while every customer digs for change or punches in their PIN code on their credit or debit card.

Think about how much time would be saved if all you had to do was show your mobile phone and you'd be set. And imagine if this power extended to other purchases: heading on vacation with a virtual butler that checks into your flight, automates your hotel check in/out and arranges your car rental.

What started out as a Natural Sciences and Engineering Research Council of Canada (NSERC) Engage Project with Sheepdog, GoogleŌĆÖs Canadian Enterprise professional, has now blossomed into a start-up company with patents pending and a mission to change how we do business.

Making the connection

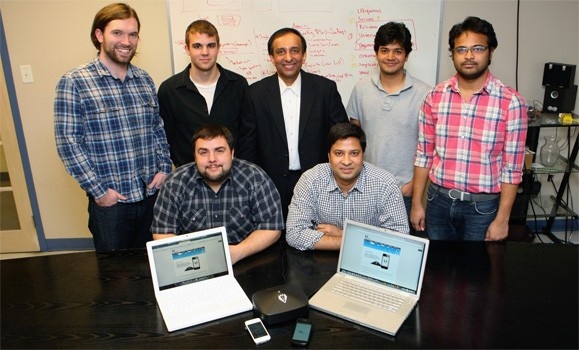

Alfred NFC was created by Brandon Kolybaba, co-founder of Sheepdog, and a pilipili┬■╗Ł team led by Computer Science Professor Srinivas Sampalli, including grad students Musfiq Rahman, Ambica Pawan Khandavilli and Karthik Palanivelu.

Dr. Sampalli and his students had been doing extensive research in areas of radio-frequency identification (RFID) and security systems, specifically as they relate to wireless networks. Mr. Kolybaba had expertise in shared cloud technologies and wanted to work with the Dal research team on connecting this work with near field communications (NFC) in mobile technology. With this marriage of research and industry, "Alfred" was born.

╠²

The idea behind Alfred is to link a userŌĆÖs identity to a known location through NFC via cloud data ŌĆō information stored on remote servers as opposed to the computer device being used.

ŌĆ£Alfred enables users of modern smartphones to tie their identity to a specific location in a secure way. That data is then available to any authorized system that is connected to the Internet,ŌĆØ says Mr. Kolybaba. ŌĆ£This technology enables both NFC enabled phones as well as non-NFC enabled phones to communicate with our connector to the cloud."

Tap and go

NFC and RFID technologies are used on a daily basis, from microchips in pets to healthcare patient tracking. Many Canadians now use NFC technology when purchasing their groceries with Pay Pass, simply by tapping their credit card on the machine.

With an endless number of available mobile apps, there are many scenarios in which Alfred could make life easier. All that would be needed is for businesses to have an Alfred device.

When you purchase your morning coffee or afternoon sandwich, or fill up your car, you'd simply scan your phone to pay. When checking into your hotel room, you'd open the hotelŌĆÖs app, tap your phone and youŌĆÖre in. Dinner reservations would get easier and airline travel quicker, and you wouldn't necessarily need keys or cards.

Alexander Hart, a Dalhousie alumnus, has now joined the team with his knowledge of embedded hardware. Mr. Hart and the rest of the team are working on finding potential clients to test out their technology before deploying Alfred on a larger scale.

ŌĆ£The ultimate goal for Alfred was to get rid of multiple readers, multiple carrier dependencies and multiple methods ŌĆō just one device, a simple plug and play,ŌĆØ says Dr. Sampalli. ŌĆ£[It will be] something simple and secure for everyone. It is exciting that we have achieved that.ŌĆØ

For more examples and details on how this device works, visit